RBI Raises India’s GDP Growth Projection

08.06.2024: The Reserve Bank of India (RBI) has increased its GDP growth projection for the fiscal year 2024-25 from 7% to 7.2%, driven by rising private consumption and a resurgence in rural demand.

Key Highlights

Strong Economic Indicators

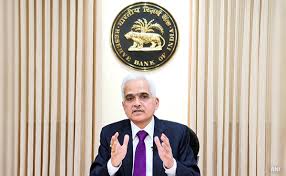

RBI Governor Shaktikanta Das announced that the National Statistical Office (NSO) estimates India’s real GDP growth at 8.2% for the fiscal year 2023-24. He noted that domestic economic activity has shown resilience, with manufacturing gaining momentum due to strengthening domestic demand. The services sector also continues to thrive, as indicated by high-frequency data.

No Signs of Overheating

Addressing concerns about potential economic overheating, RBI Deputy Governor Michael Debabrata Patra stated, “We are not seeing signs of overheating because the level of output had fallen very low during the pandemic. Even these high rates of growth are helping the economy catch up.”

Factors Driving Growth

In his monetary policy statement, Governor Das emphasized several factors contributing to the upward revision:

- Private Consumption: Recovering steadily with increased discretionary spending in urban areas.

- Rural Demand: Boosted by improving farm sector activity.

- Investment Activity: Gaining traction due to ongoing expansion in non-food bank credit.

- Agricultural Outlook: The India Meteorological Department’s (IMD) forecast of an above-normal south-west monsoon is expected to enhance kharif production and replenish reservoir levels.

Projected Growth Rates

Governor Das detailed the projected real GDP growth rates for 2024-25:

- Q1: 7.3%

- Q2: 7.2%

- Q3: 7.3%

- Q4: 7.2%

Positive Economic Environment

Das highlighted several positive indicators for investment activity, including healthy balance sheets of banks and corporates, the government’s ongoing capital expenditure initiatives, high capacity utilization, and business optimism. Additionally, improving prospects for global trade are expected to boost external demand.

Global Economic Outlook

On the global front, Governor Das noted that economic growth is sustaining its momentum into 2024, supported by a rebound in global trade. While global inflation is easing, the final leg of disinflation may be challenging. Central banks worldwide remain focused and data-dependent in their efforts to combat inflation. Market expectations about the timing and pace of interest rate cuts are evolving with new data and central bank communications.

RBI’s Independent Approach

Governor Das clarified the RBI’s stance on monetary policy, stating, “While we do consider the impact of monetary policy in advanced economies on Indian markets, our actions are primarily determined by domestic growth-inflation conditions and the outlook.” He emphasized that the RBI operates independently, guided by local economic conditions rather than merely following trends set by other central banks.

With the projected GDP growth of 7.2% for 2024-25, India is set to achieve four consecutive years of growth at or above 7%. The combination of strong domestic demand, positive investment trends, and a resilient global economy positions India for continued robust economic performance.